The FTX Story — Ethics, Oversight & Professional Judgment for CPAs

In the world of accounting and assurance, maintaining trust is non-negotiable. But as technologies evolve and regulatory frameworks expand, CPAs face ethical and judgment-based challenges that go far beyond traditional audits. That’s why earning NASBA approved ethics CPE is not simply a checkbox—it’s a strategic investment in your professional mindset and ethical resilience.

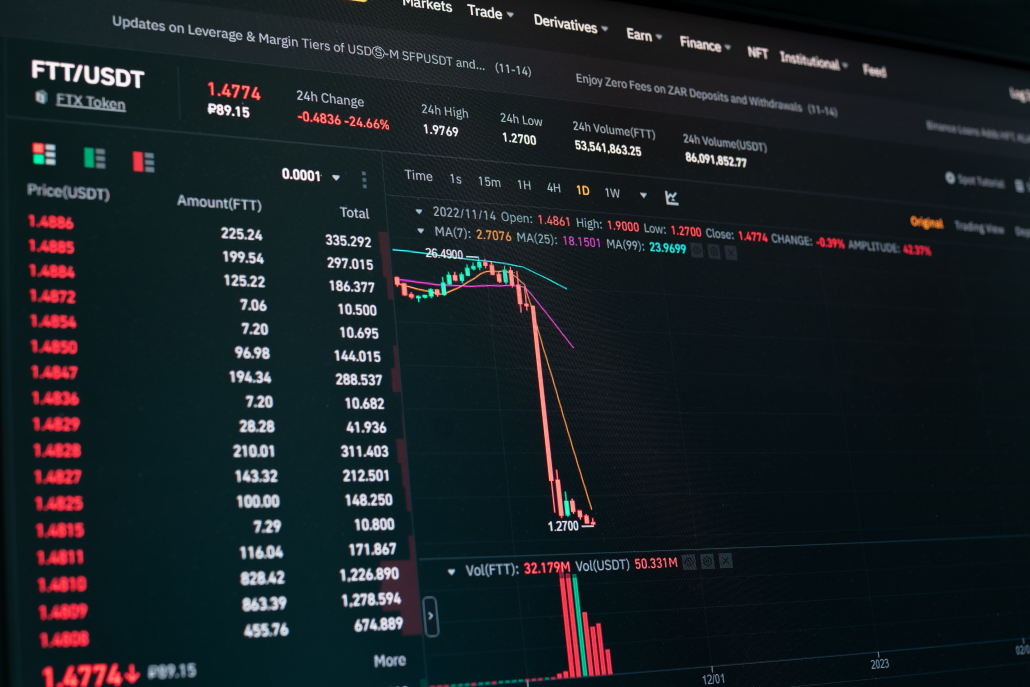

The collapse of the global cryptocurrency exchange FTX is one of the most dramatic business failures of recent years. Once valued at over $30 billion, it unraveled rapidly because of missing controls, unmonitored access, and blurred boundaries between entity and affiliate.

The Professional Ethics: The FTX Story course uses this real-world scenario to help CPAs understand how ethics, oversight structures, and decision-making combine under pressure—and how things can go wrong when all three break down.